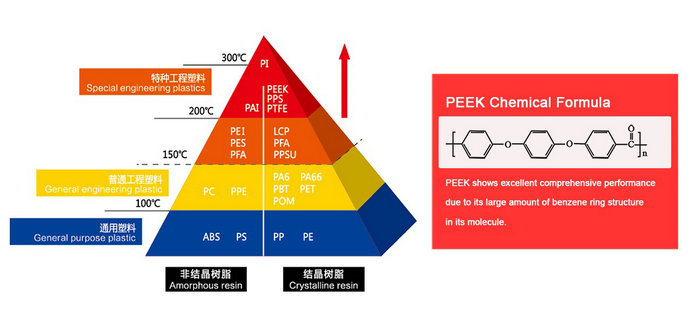

Specialty engineering plastics refer to a class of engineering plastics with high comprehensive performance and long-term service temperature above 150°C. They mainly include Polyphenylene Sulfide (PPS), Polyimide (PI), Polyether Ether Ketone (PEEK), Liquid Crystal Polymers (LCP), and Polysulfone (PSF), etc.

Specialty engineering plastics have unique and excellent physical properties, mainly used in high-tech fields such as electronics, automotive, aerospace, special industries, and precision instruments.

Compared to general engineering plastics, specialty engineering plastics have superior and unique properties, with long-term service temperatures exceeding 177°C, and are not yet produced on a large scale.

In terms of development stages, specialty engineering plastics can be defined as the third generation of polymer materials after general plastics and engineering plastics, characterized by:

1, Extraordinary stability and performance beyond traditional polymers when exposed to certain harsh environments.

2, Mainly composed of non-elastic thermoplastic materials, mainly processed by extrusion or injection molding methods.

3, High research and development costs, high selling prices. The high performance and high cost of specialty engineering plastics coexist, making their cost-effectiveness less superior compared to general engineering plastics.

Current Development Status of Specialty Engineering Plastics

China has initially achieved industrialization of varieties such as PI, PPA, LCP, and PEEK, but there is still a large gap compared to the advanced level abroad, and the industry as a whole is still in the early stage of development.

Internationally, the development of specialty engineering plastics originated in the late 1960s. European and American countries have conducted extensive research and development on specialty engineering plastics. From the polyimides introduced in the 1960s to the polyether ether ketones introduced in the early 1980s, more than ten varieties with application value and industrialization have been formed. China's specialty engineering plastics started in the mid-to-late 1990s, with a huge gap compared to leading foreign companies, and has not yet formed a large scale. The dependence on imports for most products is over 70%.

The weak accumulation of domestic original technology, significant gap with the advanced level abroad, and problems such as poor batch stability of products exist. Moreover, the product structure is not reasonable, there are few basic resin synthesis enterprises, and more modified processing enterprises; insufficient technical input, disconnect between product development and market services, and weak competitiveness of local enterprises.

Overall, domestic product supply is insufficient, the proportion of special materials is low, there are too many mid-to-low-end products, and key core products are highly dependent on imports. China's effective production capacity of engineering plastics still cannot meet domestic market needs, making it the largest importer of engineering plastics globally.

Current Development Status of PEEK in China

Polyether ether ketone (PEEK) is a semi-crystalline, thermoplastic aromatic polymer material, the most important variety in the polyarylether ketone (PAEK) series polymers, with flexibility and excellent processability. It is widely used in aerospace, automotive, electronics, medical, and other industrial fields.

The development of PEEK technology in China started relatively late, and Jilin University is a representative research institution in the PEEK industry. China's PEEK production capacity is mainly concentrated in ZYPEEK, ARKPEEK, and Changchun Jidatech Plastics, accounting for 80% of China's total production capacity, with China Research producing 1000 tons/year, ranking first in the country. However, compared with international leaders, there is still a certain gap in actual production and product quality.

From the perspective of domestic market demand, with the continuous development of China's electronics, aerospace, and automotive industries, driving the rapid growth of PEEK material market demand, China has become one of the important markets globally. According to data, by 2024, China's PEEK material market consumption demand has reached 1600 tons, with a compound growth rate of 40% from 2025 to 2030.

In the next 5 years, China's PEEK production capacity will continue to expand. Currently, Victrex and Xinfu Chemical have announced the establishment of joint ventures in Panjin, with an expected construction of 1500 tons/year PEEK production capacity.

Analysis of PEEK Prospects

With technological progress and process improvement, there is an increasing demand for PEEK specialty engineering plastics. The development trend of replacing steel with plastic, replacing wood with plastic, lightweighting, and miniaturization provides broad market space for the specialty engineering plastics industry. At the same time, various specialty engineering plastics can further improve product performance, and a larger proportion of specialty engineering plastics will be applied in downstream industries in the future.

The future development of PEEK specialty engineering plastics in China focuses on four key points:

1, Improve the technical level and scale of industrialized varieties already achieved, and improve product quality.

2, Strengthen the construction of industry-university-research alliances, accelerate the transformation of scientific research results, and accelerate the industrialization of blank varieties.

3, Break through the supply bottleneck of key supporting materials and reduce costs.

4, Focus on the development of modification technology and application technology.